When it comes to coverage detection, how much is slipping through the cracks?

As medical plans become increasingly complex and ambiguous, it poses a challenge for patients and providers alike. Many patients may be confused by their coverage, or not even be aware they have it at all. In addition to receiving inaccurate information from patients, limited staff bandwidth and the lack of supporting tools make it difficult for providers to bill the right payer first — or know when to collect from the patient.

Your health practice likely has its own strategy in place to identify patient coverage and work through these obstacles. However, if you are using an inefficient or highly manual process, you could be letting crucial dollars go uncollected.

Recently, Waystar launched an online survey to help health practices estimate how large of an opportunity they have to find more coverage and reduce the cost-to-collect. Hundreds of organizations answered — and now we’re sharing the key takeaways.

We’ve tallied the responses so you can gain insight from providers just like you and find new strategies for success.

Boost efficiency + minimize manual work

If your practice is still relying on a manual coverage detection process like more than half of our respondents, you could be spending more than it’s worth to chase collections.

With a manual process, you also expose your organization to a higher risk of human error. Whether it’s verifying coverage through a phone call or online, staff can have a hard time keeping up with a manual verification process — and it could even cause them to overlook coverage unintentionally.

However, with the power of an industry-leading coverage detection solution, you can alleviate the administrative pressure on your team and accelerate the process, which is a huge win with staffing shortages at an all-time high.

Using automation strategically allows staff members to detect insurance coverage in cases quicker and easier than ever before, allowing them to focus their energies on more meaningful tasks.

Get compensated for care

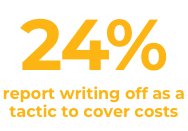

While write-offs may be unavoidable in some cases, many self-pay and uninsured patients have hidden medical coverage that you — and they — are unaware of. In fact, more than 30% of self-pay patients have full or partial coverage that they know nothing about.

Some patients may be covered by more than one insurance company or government agency. Others may qualify for charity care, disability coverage, or workers’ compensation coverage, providing alternative ways to lessen their financial burdens.

Educating patients about their coverage and having transparent discussions about costs goes a long way to gain trust.

Don’t miss out on important opportunities to capture coverage and find billable insurance. Leverage cutting-edge technology and tools to identify coverage so your health practice stays in good financial standing, now and in the future.

Find coverage other vendors can’t

If you are utilizing a vendor with inferior technology, they could be holding you back — and clogging up critical cash flow to your organization. Without accurate technology, looking for active insurance takes a lot of time with often little reward.

But what if you could identify coverage without it feeling like a wild goose chase, and have confidence in the results?

To get the most out of your revenue cycle, it takes a trusted partner to be strategic about finding hidden coverage other vendors may miss, verifying eligibility, and surfacing recoverable opportunities.

When determining if your vendor is the right fit, be sure to understand what information they utilize for determining coverage. Some questions you may need to consider are:

- Does your current vendor leverage third-party databases with limited and potentially outdated data pools?

- Do they provide a confidence rating for the coverage found, or would your staff end up double-checking results anyway?

- Does your vendor offer pre-claim coverage detection ensuring coverage is identified and accurate prior to the claim going out the door?

Choosing a partner with extensive, accurate data built on deep revenue cycle knowledge means getting more money in your practice’s pocket, while making it easier for your patients to fulfill their financial responsibilities.

Maximize self-pay revenue

With smarter solutions, you have the power to resolve self-pay accounts in-house and eliminate the need to outsource, saving time, and lessening the number of AR days waiting for vital revenue funds.

Identifying hidden coverage also has a longer-lasting impact on your business. Finding coverage for the people you treat builds better, more trusting partnerships, helping foster patient loyalty.

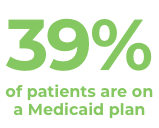

Find solutions before filing Medicaid

Leverage the learnings

Your health practice has taken steps toward a better coverage detection process. However, if you’re like many organizations, your current approach could be leaving money on the table.

How does your health practice measure up? Take the coverage detection quiz and find out for yourself. If you’re ready to put these strategies into action, discover the power of Waystar’s Coverage Detection solution.

No matter your coverage detection challenges, Waystar is here to streamline your coverage detection process. That way, you can focus on what matters most: caring for patients.