Revenue cycle management strategies are a dime a dozen. So, how do you know which ones will actually boost productivity?

You ask the experts. That’s exactly what we did in a recent Q&A: How do we fix workforce efficiency in healthcare?

During this session, Waystar experts put decades of industry experience to the test. By answering audience questions live, they explored revenue cycle management strategies that they know, from experience, work.

Meet our experts

Rebecca Pierce

Director of Product Management

Christine Fontaine

Solution Strategist

Judd Chamberlain

Solution Strategist

Explore questions related to:

- Prior authorization

- Claim statusing

- Staff training

- Key productivity metrics

- How to address a denials backlog

REVENUE CYCLE MANAGEMENT STRATEGIES: PRIOR AUTH

Q1: Prior authorization is the most time-consuming front-end process at my organization. How can we save time and make it more efficient?

Christine: There are three topics I’m constantly talking to clients about: prior authorizations, claim statusing, and denials. When I think back to the way that my staff used to do it, they would print out all the published rulesets from the payers, put them all over their cubicles, and they would think, ‘Okay, I know the rules.’ Well, rules change. And they’d get it wrong.

Solution 1: Stop maintaining a rules engine.

Christine: Now that automation is here, it’s time to stop maintaining a rules engine. It’s tedious. It’s time-consuming. And staff can’t stay on top of rules with spreadsheets anymore. Take this type of decision-making off their plate. Leverage a platform that can make these decisions for you.

Solution 2: Drive by exception.

Christine: Today, automation can be used to drive, accelerate, and guide the initiation process. Now, technology can’t do it all — nor should it. There are some compliance issues you want to consider when using a bot to enter clinical data. But if a request for authorization is processed, certified, and all your CPT codes are good, staff shouldn’t touch it. They should only get involved when remediation is needed.

How much of your prior auth problem will that solve? If automation takes care of even half your prior auths, well, you’ve improved productivity by 50% right away — and that’s before you even consider how it will reduce your denials.

REVENUE CYCLE MANAGEMENT STRATEGIES: CLAIM STATUS

Q2: Our staff prioritizes claim corrections, denial review, and appeals over claim status. How can we more effectively status claims for a downstream effect?

Rebecca: As someone who looks across the whole AR follow-up process, I think claim statusing doesn’t get the love it deserves. When used properly, claim statusing should either (1) empower your downstream workflows or (2) mitigate that work. To ensure your process is doing that, ask yourself: Are we using and making sense of our statusing data?

Solution: Use your data to create a proactive process.

Rebecca: Once you dig into the data, don’t wait to make changes. See if there are opportunities to gather certain information upfront, and try to identify when workflows will need to be kicked off sooner rather than later.

If you’re working denials today, you should have access to data that helps you answer:

- What are the common cases?

- Can any of those be identified prior?

- Can I go ahead and respond to requests for information?

- Can I proactively engage other departments to gather the necessary information and appeal it when the remit does come through?

Again, the bottom line is you don’t have to wait. Review, see what the data is telling you, and then optimize your process.

REVENUE CYCLE MANAGEMENT STRATEGIES: TRAINING

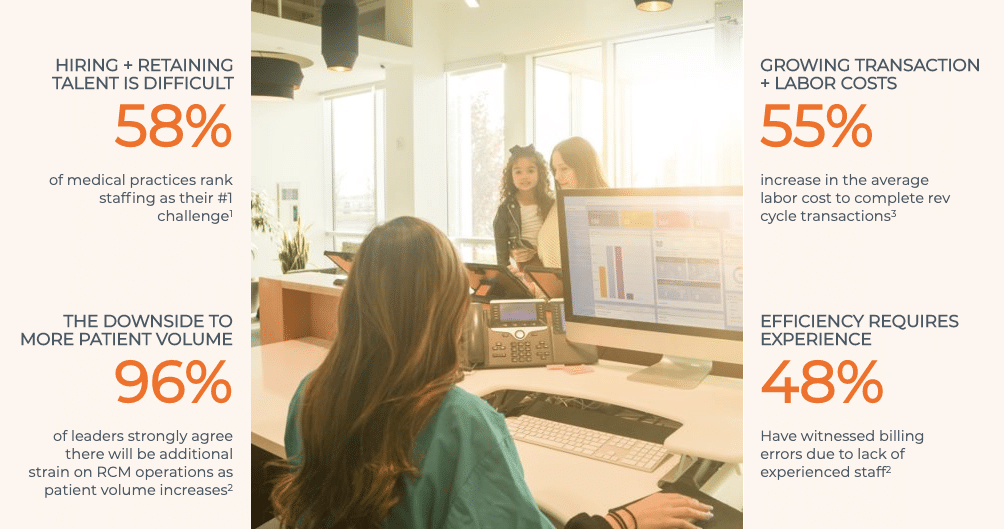

Q3: Hiring and training staff is challenging but crucial to making automation work. How do you train staff while managing their high workload?

Christine: You have to have an intuitive tool.

- If you’re talking about a claim, is it clear what fields need to get corrected, or why it was rejected?

- Does staff have access to tutorials that tell them, for a particular reject from a payer, how to fix it?

If your tool doesn’t make working in it easy, training never will be.

Solution: Give staff intuitive tools + universal protocols.

To get people up to speed faster:

- You need a fixed system that all staff works through.

- Ideally, that system will include easy training tools right there within the platform that can tell staff how to fix their problems.

- Finally, that platform will allow for customization so staff can save and track what works.

Christine: For example, consider ‘saved responses.’ Say a staff member is appealing a batch of authorization denials. You want staff to know which attachments are needed, and you want them to use approved, consistent language that you know works to get appeals overturned. If your platform has functionality like saved answers, staff can store, access, and use that information right from within the system.

REVENUE CYCLE MANAGEMENT STRATEGIES: METRICS

Q4: There are so many metrics to track at a leadership level. In your experience, what metric or specific KPI is the most valuable to track?

Metric 1: Days in AR

Judd: AR days stands out to me because it gives you that 50,000-foot view. But make sure it’s accurate. Looking at total charges, days in AR, is not necessarily a realistic way to see how much money you have out there because you’re not going to get paid what you bill. So it’s important to be able to net that down to what you can realistically expect on the front end.

Metric 2: Cash collection as a percentage of net revenue

Christine: The key metric for me was the one my CFO was looking at, and that was cash collection. There are a lot of ways to play around with net revenue or days in AR, but not cash. If you’ve got calculations and you’re not collecting — close to 100% every month — you’ve got holes. I always prioritized that because it led me to everywhere else there were holes.

Metric 3: Adjustments

Rebecca: One simple one I’d throw out is adjustments. How am I getting paid? What adjustment groups and codes are we seeing? It’s a very simple metric but a very enlightening one.

Metric 4: First-pass yield

Judd: I’d also recommend looking into data around your first-pass yield, or the percentage of claims paid correctly on the first submission. This puts the emphasis on denial prevention, which stops the problem before it starts.

REVENUE CYCLE MANAGEMENT STRATEGIES: DENIALS

Q5: Our denial backlog is growing. Leadership has moved more staff to denials, but it isn’t having the desired effect. Any suggestions?

Step 1: Gather data.

Christine: When I was running a rev cycle, I knew I had a lot of denials. So, I went to the lab department and said, ‘We’ve got a lot of denials due to lab,’ and they asked, ‘How many?’ I said, ‘Well, I don’t know. But it’s a lot!’ As you can imagine, our lab director kicked me right out of his office. And that’s why I know the first step of any denial-prevention strategy has to be data.

Step 2: Do an all-hands-on-deck analysis.

Christine: Second, bring all your departments to the table. When we were getting denied for no authorization on file, I got with our Financial Clearance team and looked into the data. When we checked it, authorization was on file or not required. But many times, the patient came in for a radiology exam, they added on or completely changed the order, resulting in the denials. So, we worked with radiology. And we figured out that if we identified that when that order changed in the radiology system, we could fax or send an email directly to the financial counselor, and they would prioritize getting that authorization updated — if we did it the same day, with a reason. With just that effort, we reduced our denials by more than $100,000 per month.

Christine: When you think about the fact that 65% of denials never get touched, that’s kind of ridiculous. You’re never going to work your way through that backlog. But you can work it from the other end — through prevention, so you don’t get denials in the first place.

Want to know more about denial prevention + recovery?