Note: This post was originally published in August 2022. It was updated in January 2025.

Verifying insurance eligibility can feel like a tedious, endless task. Without the right processes in place, staff spend countless hours on manual eligibility checks that drain time and resources. On top of this inefficiency, delayed or incorrect insurance eligibility verification can lead to:

- Missed reimbursements

- More uncompensated care

- Lower revenue

Why verifying insurance eligibility is pivotal when patients pay

Today’s patients are shouldering more of their care costs than ever before, and high or unexpected outstanding balances can negatively impact both their experience and satisfaction.

One big reason: Patients aren’t always up to speed on their current benefits and financial options, even when they actually have insurance coverage that could lighten their financial load. In fact, Waystar finds that 30-40% of presumed self-pay patients have some form of insurance, whether commercial, governmental, or a combination. The right coverage detection technology can find this insurance, allowing providers to collect a greater portion of care costs from payers — rather than patients — and increase point-of-care collections.

3 reasons real-time insurance eligibility verification matters

Timely insurance verification is crucial, as providers are far less likely to collect payment after a patient leaves the facility. Leveraging real-time solutions to verify insurance at the time of service has three major benefits:

- Enhancing revenue capture

- Easing the patient’s financial burden, and

- Streamlining the billing process from front to back.

How providers can find more coverage + collect fuller payment, faster

1. Take proactive steps to find hidden insurance coverage

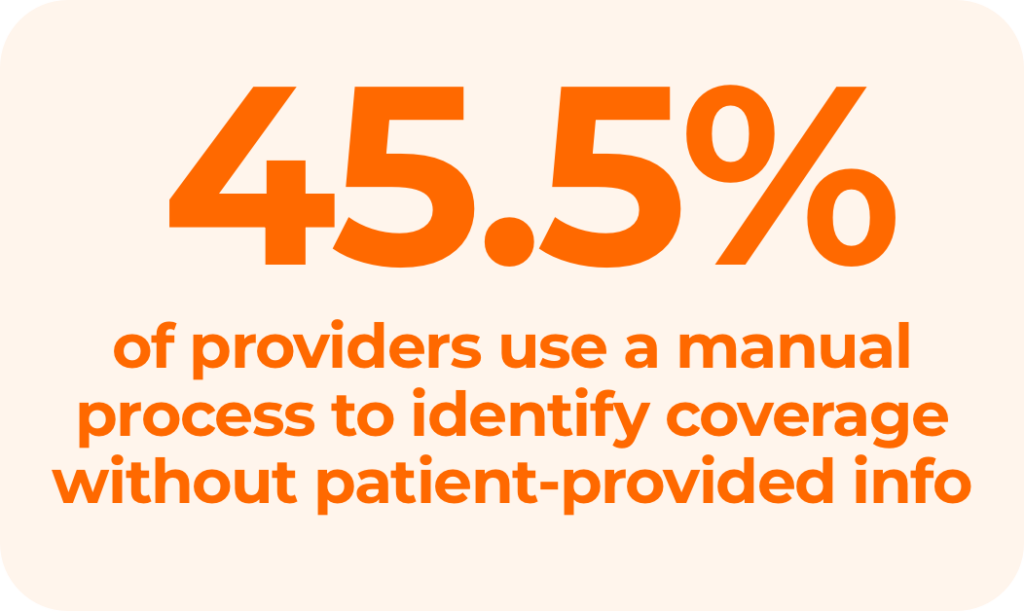

Without the right software, tracking down patients’ missing or unknown insurance coverage is time-consuming, costly, and involves multiple steps.

At the front end, patient access staff try to verify insurance eligibility before scheduled appointments. If they can’t, either the billing staff writes off the account, AR staff starts collections, or the account is outsourced to a third-party company for collection. Unfortunately, patient collection rates have decreased to 48% in recent years, increasing bad debt for providers and negatively impacting cash flow, revenue, and patient relationships.

An automated Eligibility and Coverage Detection solution that verifies active, billable coverage can empower your team to collect more revenue and lower bad debt. Leveraging these tools at the time of service can provide you with real-time information that can help you:

- Reduce denials

- Increase collections

- Boost cash flow

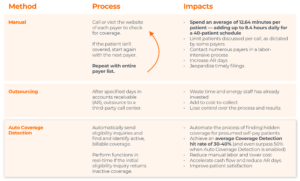

Methods for verifying insurance eligibility

2. Create a holistic strategy for patient communication and collection

Automated eligibility and coverage detection solutions can make a big difference in how much providers get paid — and how quickly.

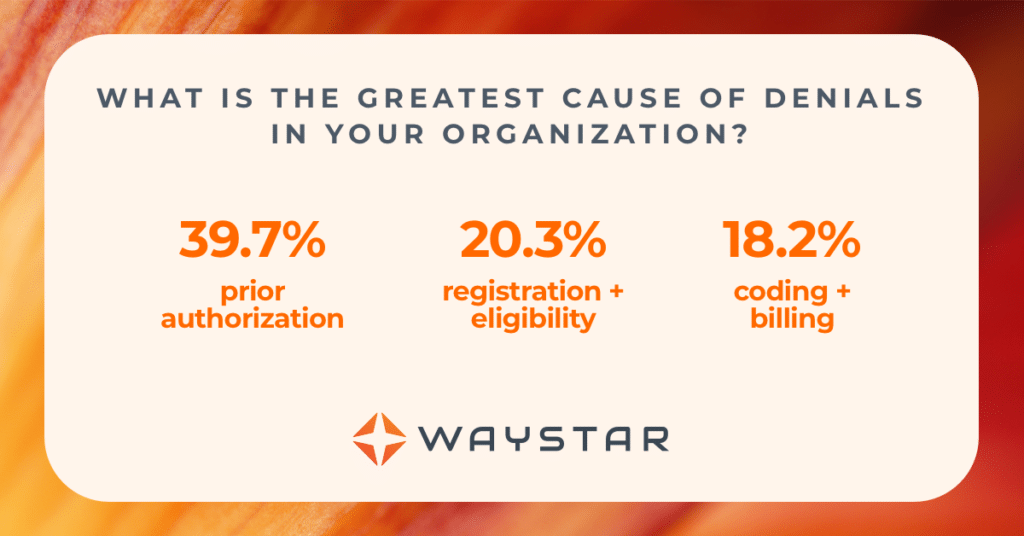

Ineligible patient coverage is a leading cause of payer claim rejections and denials. But a coverage detection solution is really just one part of a larger strategy that can make life easier for your patients and your staff.

A proper holistic strategy considers how the solution:

- Works within your larger RCM framework

- Complements your patient engagement efforts

- Can improve or support other vital areas of your rev cycle, such as patient communications and estimates

With an automated solution, teams get critical financial information to patients as early as possible. A quick check using a coverage detection tool allows staff to find options the patient may not otherwise be aware of and even opens up an opportunity to collect from the patient at the point of service. Doing so ensures patients’ balance and financial responsibilities are presented in straightforward language.

Ask yourself: Would a patient need help to understand this bill or their responsibility? If the answer is “yes,” reconsider your strategy and your tools.

A holistic strategy will:

- Give patients convenience and flexibility in their payment options

- Streamline the collection process

- Reduce costs by saving your staff time, and

- Increase patient satisfaction and loyalty.

Ultimately, it’s those net benefits that will have the biggest impact on your bottom line.

Maximize revenue with insurance eligibility verification software

Waystar’s Coverage Detection solution can identify not only primary coverage but also help determine coordination of benefits when a patient has multiple health plans — and it can do both with simple information, such as patient name and date of birth.

This automated approach to insurance eligibility verification leads to the discovery of up to 40% more billable insurance, as well as:

- A reduction in collection costs

- Increased patient satisfaction and revenue

- More billable opportunities pinpointed by reporting and dashboards

- Optimized patient-collection workflows with automated batch and single-patient inquiries

- Real-time access to accurate insurance eligibility and coverage details

Learn about finding more coverage for patients, automating your insurance detection processes, and calculating your organization’s potential savings and annual recoupment.