Price transparency resource center

Empower your patients + ensure CMS compliance

Price transparency is a perennial issue in healthcare. When patients don’t know in advance what they will owe, it could lead to financial stress and inability to pay after point-of-service. This results in patient dissatisfaction and makes it more difficult for providers to collect payment. As an added challenge, CMS has mandated that hospitals publish meaningful price information for patients— effective January 1, 2021.

Waystar has you covered. We hope you find the price transparency resources collected here useful as you prepare to fulfill the CMS mandate. Our experts at Waystar are here to answer any questions you have about price transparency and the CMS mandate.

Upcoming + recent price transparency webinars

We’ll be hosting webinars to keep you informed about price transparency updates, readiness preparation and the revenue cycle management solutions that can help you succeed.

June 18

Price Transparency Mandate –

Making Sense

of the CMS

Final Rule

June 9

Complying with CMS Price Transparency Requirements –

Strategies for

Organizational

Readiness

August 6

How Waystar

Supports Price

Transparency

What you need to know for Jan 1, 2021

There are two primary requirements for hospitals to publish standard charges. See below for a summary:

- Applies to all hospitals

- Update at least annually

- Must be prominently displayed + easily accessible

- Daily $300 penalty for noncompliance

Reach out to Waystar to find out more about how we can help your organization meet the CMS mandate and improve your patient financial experience.

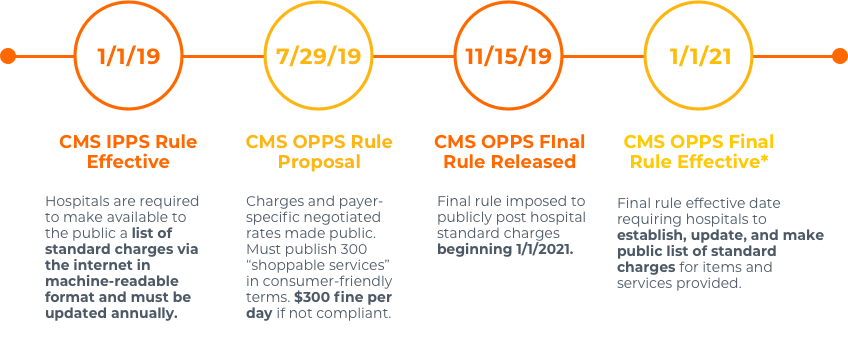

The CMS transparency timeline

On November 15, 2019, CMS finalized policies requiring hospitals to disclose standard charges for items and services in the hopes that patient-driven shopping will create market competition and ultimately make healthcare affordable. See a snapshot of how the timeline is unfolding and what it means for your organization.

* Recent litigation has ruled in favor with HHS, however plaintiffs plan for an expedited appeal which could impact Final Rule effective date and/or requirements.

Stay up to date with the final rule

Please click the links below for healthcare price transparency resources and updated information about policies and deadlines.

Fact sheet: CY 2020 Hospital Outpatient Prospective Payment System (OPPS) Policy Changes: Hospital Price Transparency Requirements

Fact sheet: Transparency in Coverage Proposed Rule

Hospital Price Transparency Presentation

HealthLeaders article on final price transparency rule

U.S. hospitals lose legal challenge to Trump price transparency rule

Solve your price transparency

challenges with Waystar

Empower your patients to make informed healthcare decisions with Waystar’s Price Transparency solution. This market-tested, self-service tool generates accurate estimates in consumer-friendly terms.

The Price Transparency tool can be deployed on your patient portal or website, giving patients a web and mobile-friendly price shopping experience.

Key benefits of our price transparency solution include

- Real-time patient-generated estimates for most shoppable procedures

- Consumer-friendly terms allow for easy search and selection

- Requires minimal patient input to retrieve complete out-of-pocket details

- Intuitive scheduling and financial assistance tools

- Auto-attaches known complementing charges to increase accuracy rates

Work with Waystar to give your patients the information and level of service they deserve. Learn more about healthcare price transparency by clicking through the resources below.