Today, many patients face a distressing decision: the choice between care and cost.

Expenses are rising everywhere — grocery prices alone spiked 23.6% from 2020 to 2024. In healthcare specifically, out-of-pocket costs have soared in the past decade. U.S. patient responsibility now totals more than $471 billion at a time when nearly 75% of patients struggle to pay healthcare bills — and one in three Americans delay medical treatment due to cost.

So, it’s no wonder that when it comes to paying for care, even the slightest barrier — a confusing statement, limited payment options, a lack of transparency — can prevent someone from paying at all.

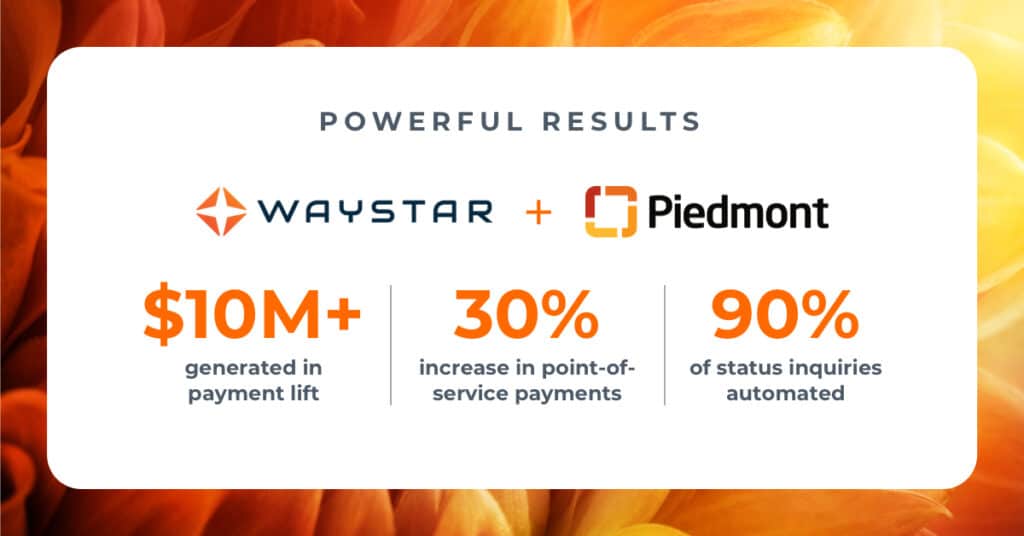

However, healthcare organizations are seizing the opportunity to extend care beyond the clinic. With the right revenue cycle software solutions, providers can both support patients in getting the care they need and empower them to pay for it with confidence.

WATCH: SCA Health + Piedmont maximize convenience + collections

PATIENT FINANCIAL CARE

Creating a consumer-friendly financial care model

Providers must embrace a new approach, and one that strengthens the patient relationship and improves financial outcomes. Patients expect the same convenient, accessible financial experience from their healthcare provider as they do from shopping online:

- Simple communication

- A clean, digital experience

- Flexibility to pay on their own terms

When paying for care is anything but straightforward, organizations risk delayed collections, poor satisfaction scores, and long-term damage to patient relationships.

Waystar’s Patient Financial Care solutions are designed to ensure that every billing touchpoint is intuitive, statements are crystal clear, and payment options are tailored to meet the patient’s unique preferences, ultimately integrating billing into the full care journey.

Both large health systems and small, single-specialty practices can harness the same modern, powerful tools to guide the financial journey forward.

PATIENT pAYMENTS

1. Digital-first billing

With Waystar’s digital-first billing, statements are delivered based on each patient’s preferred communication method — text, email, or print — dramatically cutting costs and improving engagement.

Patients benefit from personalized payment plans and can pay using their channel of choice:

- Apple Pay

- Google Pay

- Mobile pay

- Text-to-pay

- Interactive Voice Response (IVR)

These self-service tools aren’t just nice to have. Up to 80% of patients actively use self-service tools, which drastically reduces call volumes and frees up staff for higher-level tasks.

PATIENT pAYMENTS

2. Personalized Video Bill

Most patients aren’t sure what their bill means or how to pay it — so they don’t.

Waystar’s Personalized Video Bill solves that with a simple walkthrough tailored to each individual patient. The video explains:

- What services they’re being charged for

- What portions insurance did cover, and

- What to do next.

It’s like a one-on-one financial support session, but without adding work to RCM teams.

PATIENT pAYMENTS

3. General Ledger

Patient payments aren’t just tied to clinical care. Parking fees, gift-shop sales, and cafeteria charges all need to be tracked and reconciled, too.

Waystar’s General Ledger capability automates those patient charges using simple dropdown menus to cut down on errors and manual tasks — all within the familiar Waystar interface.

The way to provide patient financial care

Every revenue cycle expert knows that results are only as good as the data fueling them. When data is connected through a secure software platform, processes are optimized through daily touch points, whether you’re:

- Verifying eligibility

- Generating accurate estimates

- Securing prior authorizations, or

- Submitting clean claims.

And that creates a seamless, data-driven experience.

Strengthen patient loyalty + simplify payments

To see how these solutions can reshape healthcare payments for your organization, speak to a Waystar expert today.