Your introduction to the basics behind understanding the healthcare revenue cycle. This week: the life cycle of a medical bill.

With high deductible health plans on the rise, the recent explosion of telehealth appointments due to COVID-19 and many other factors in play, it’s more important than ever for everyone to understand how the medical billing process works. The healthcare revenue cycle is relevant to all of us as patients — not just those who work in healthcare.

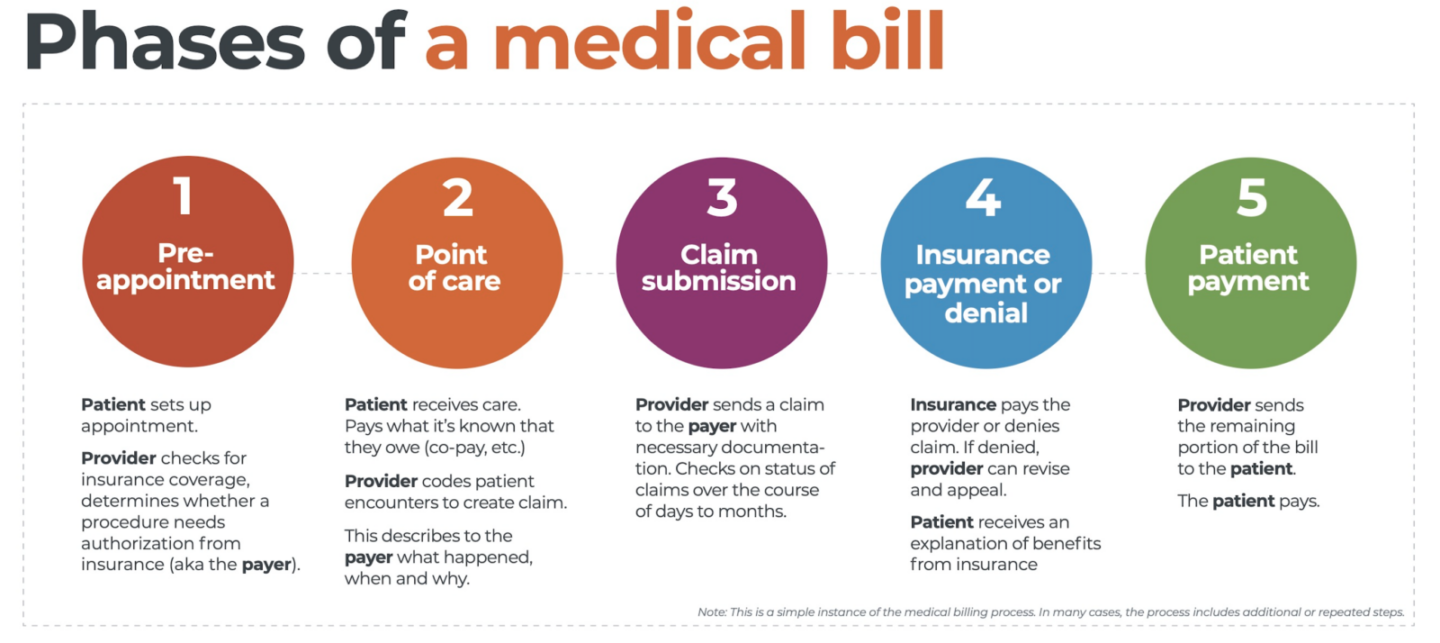

The revenue cycle is the series of processes around healthcare payments, from the time a patient makes an appointment to the time a provider is paid — and everything in between. One way to think of it is in terms of the life cycle of a medical bill. Although there are many ways this process can play out, we’ll lay out a common example below.

1. Pre-appointment

For most general care, the first stage of the revenue cycle begins when a patient contacts a provider to set up their appointment. Generally, this is when relevant patient information will begin to be collected for the eventual bill, referred to on the financial side of healthcare as a claim.

At this point, a provider will determine whether the appointment and procedure will need prior authorization from an insurance company (referred to as the payer). Also, the electronic health record (EHR) used to help generate the claim starts here, and will begin to accumulate further detail as the provider sends an eligibility inquiry to check into the patient’s insurance coverage.

2. Point of care

The next step in the process begins when the patient arrives for their appointment. This could include when a patient arrives for an initial consultation, an outpatient procedure, or a follow up exam. This could also include a telehealth appointment.

At any of these events, the provider may charge an upfront cost. One example of this is a co-pay, which is the set amount patients pay after their deductible if they are insured, but there are other kinds of payments that fall into this category.

3. Claim submission

After the point of care, the provider completes and submits a claim with the appropriate codes to the payer. In order to accomplish that, billing staff must collect all necessary documentation and attach it to the claim.

After submitting the claim to the payer, the provider’s team will monitor whether a claim has been been accepted, rejected, or denied.

Medical coding refers to the clerical process of translating steps in the patient experience with reference numbers. The codes are normally based on medical documentation such as a doctor’s notes or laboratory results. These explain to a payer how a patient was diagnosed and treated, and why. This information helps the payer decide how much of an encounter is covered under any given insurance plan, and therefore how much the payer will pay.

4. Insurance payment or denial

Once the payer receives the claim, they ensure it contains complete information and aligns with provider and patient records. If there is an error, the claim will be rejected outright and the provider will have to submit a corrected claim.

The payer then begins the review process, referred to as adjudication. Payers evaluate claims for accurate coding and documentation, medical necessity, appropriate authorization, and more. Through this process, the payer decides their financial obligation. Any factor could cause the payer to deny the claim.

If the claim is approved, the payer submits payment to the provider with information explaining details of their decision.

If the claim is denied, the provider will need to determine if the original needs to be corrected or if it makes more sense to appeal the payer’s decision.

Following adjudication, the payer will send an explanation of benefits (EOB) to the patient. This EOB will provide a breakdown of how the patient’s coverage matched up to the charges attached to their care. It is not a billing statement, but it does show what the provider charged the payer, what portion insurance covers, and how much the patient is responsible for.

5. Patient payment

The next phase occurs when the provider sends the patient a statement for their portion of financial responsibility. This stage occurs once the provider and payer have agreed on the details of the claim — what has been paid and what is still owed.

The last step occurs when a patient pays the balance they owe the provider for their care. Depending on the amount, the patient may be able pay it off all at once, or they might need to work with the provider on a payment plan.

The wrap up

The above example only represents one way a medical bill could play out. Steps are often added or repeated. Because of the complexity of healthcare payments and the parties involved, there is not always a straight line from patient care to complete payment. That’s why we call it the revenue cycle.

Waystar aims to simplify healthcare payments. Our technology automates many parts of the billing process laid out above so it’s less time and energy-intensive for providers and their teams — and more transparent for patients. Learn more about how Waystar’s platform automates manual tasks and streamlines workflows. When the revenue cycle is operating at its most efficient, providers can focus their resources on improving patient care. And that’s a better way forward for everyone.